Web3

Web3 explained

What is web3?

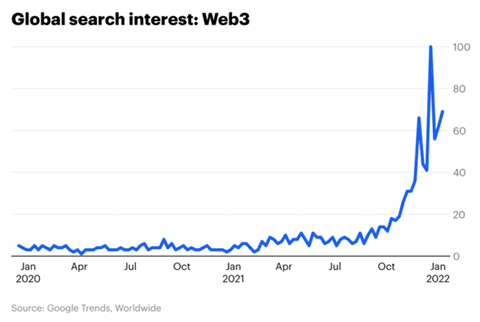

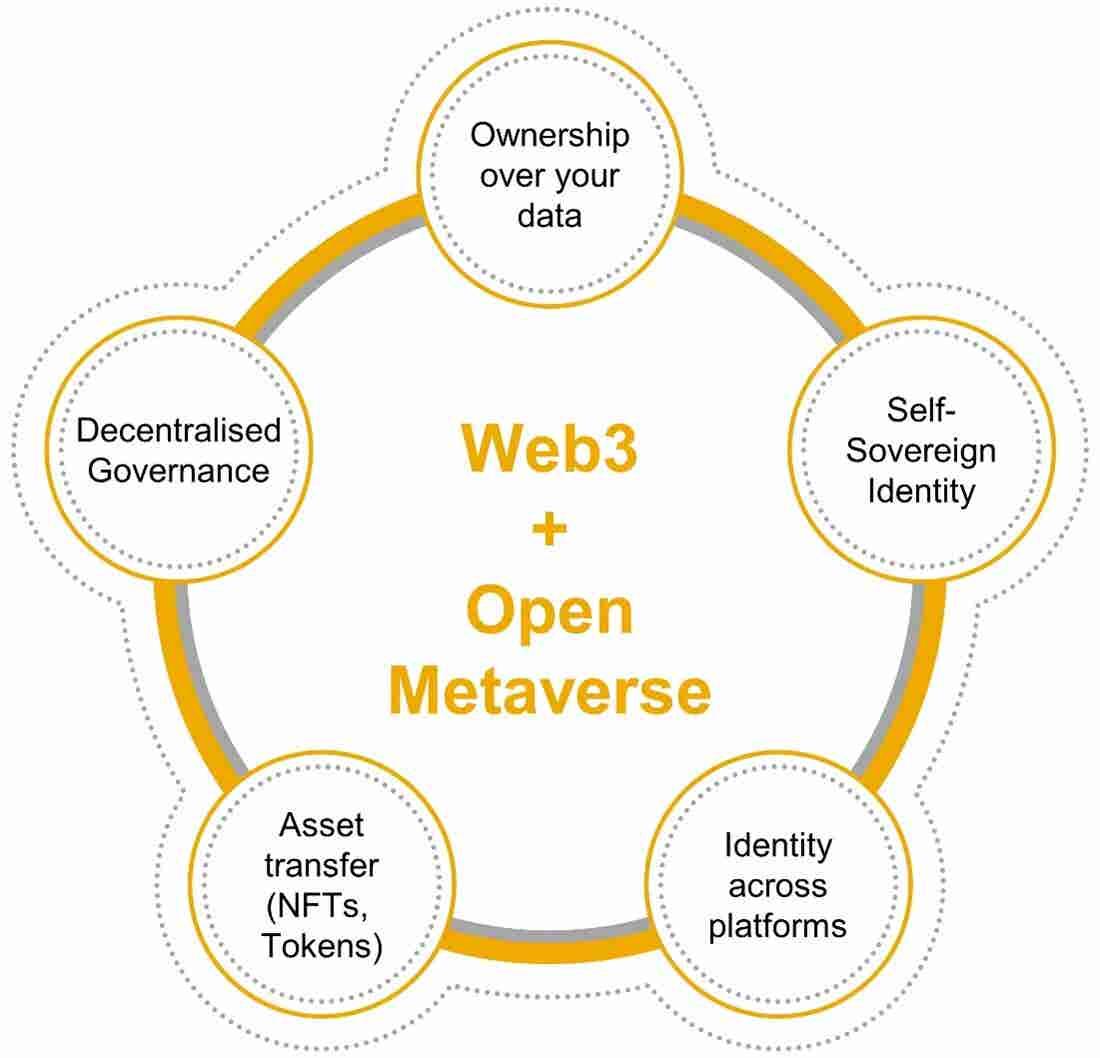

Web3 is a paradigm that aims to provide solutions to the existing problems of Web 2.0. The problem surrounding breach of security and privacy, and the inability to have control over data are to be addressed in Web3 by assuring the sense of ownership and control. Web3 is a trustless, permission-less, and decentralized internet that leverages blockchain technology.

The Evolution of the Web - from Web 1.0 to Web 3.0

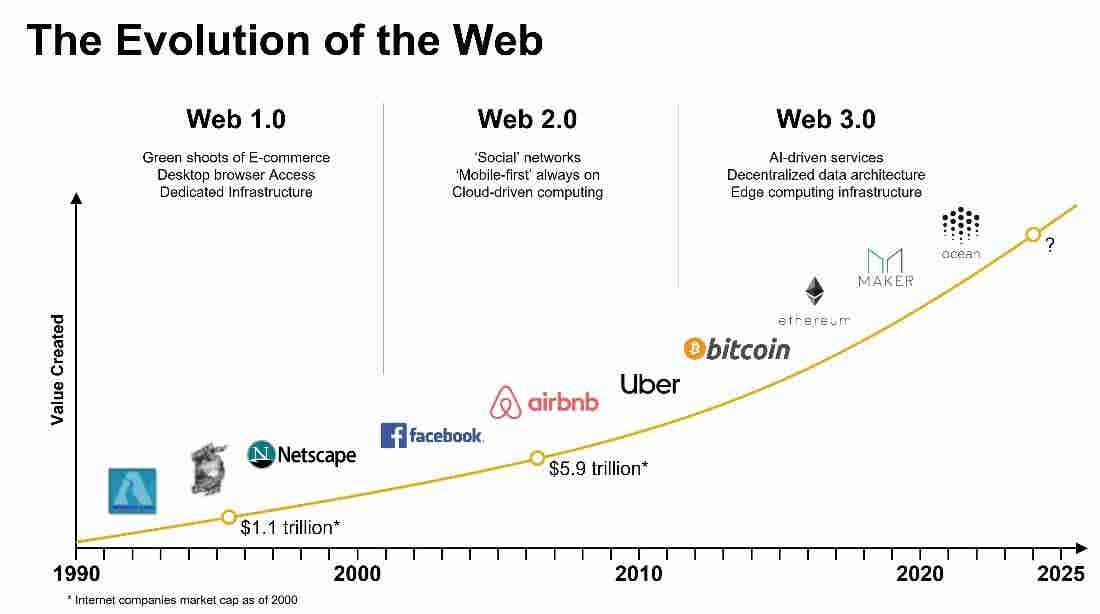

Web 1.0 - First version of the web. Also referred to as read-only web. Websites were static and not interactive. Information made available to a larger audience was the primary goal of Web 1.0. With increased capacity of servers, network speeds and new web technologies, Web 2.0 became mainstream.

Web 2.0 - The evolved version of Web 1.0 also referred to as read-write web. Dynamic, user generated content was made available to the users. Web 2.0 is seen as a revolution in business and enterprises. Web 2.0 also led to the rise of social media networks.

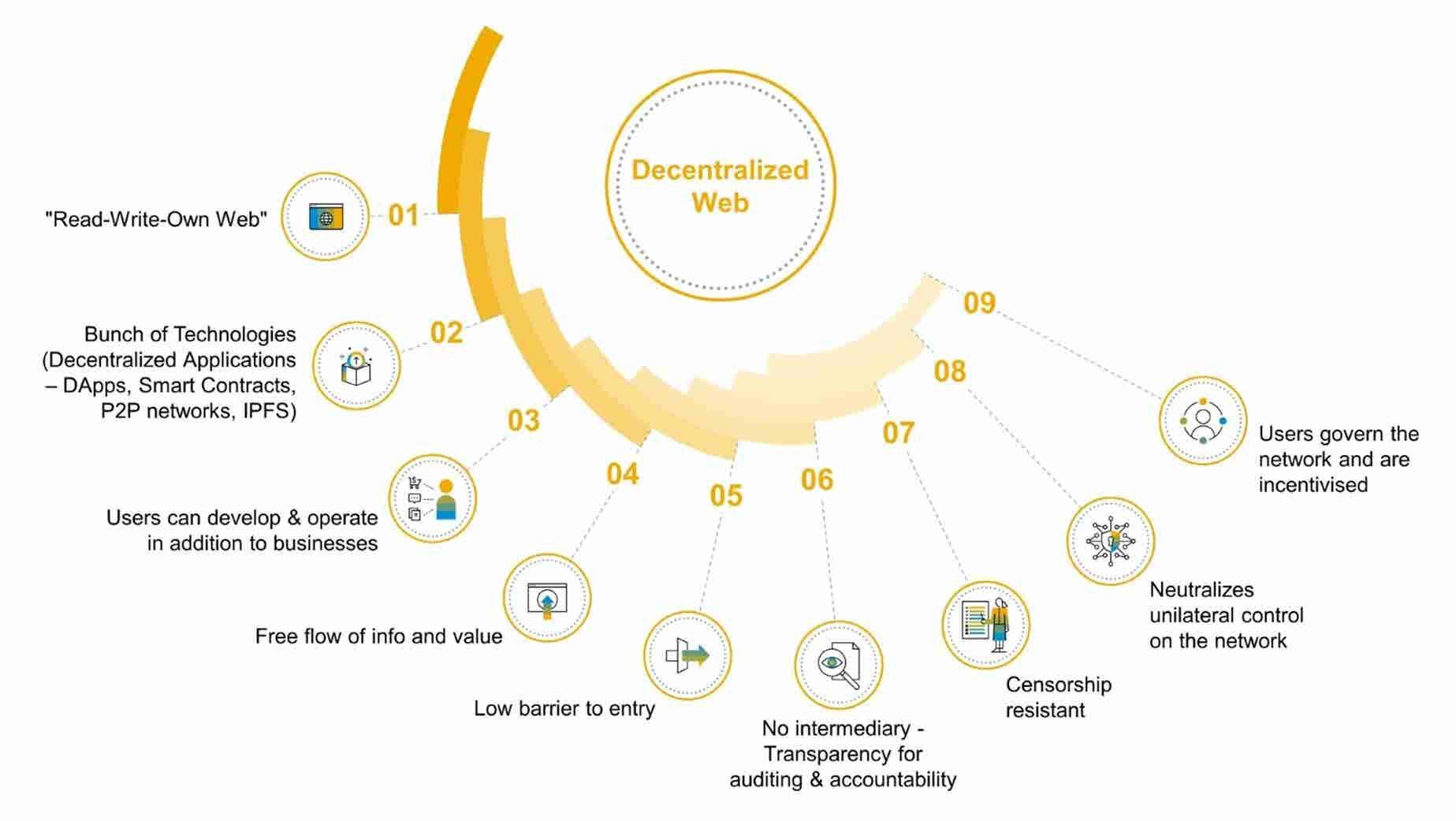

Web3 – The third version of the web (read-write-own web) which is seen as the future of web technologies. Web3 is not one technology but a bunch of different technologies. Applications developed for Web3 will be decentralized (e.g., DApps), running on peer-to-peer networks such as Ethereum and with file systems such as IPFS.

The need for Web3

Web3 addresses the problems which come with web2 namely, breach of security & privacy, censorship & surveillance, misinformation & data loss, advertising being the default business model and monopolies.

Web 2.0 offers users the ability to read and to write. This has become popular through offerings from large corporations like Google, Facebook, TikTok and Twitter. Users can, without specific technical knowledge, write on the internet by posting on Facebook or uploading a video on TikTok. By creating content via these platforms, users hand over the ownership of their content to the platform providers who in turn monetize the content. Some platforms do reward a certain part to users, but compared to their overall revenues, revenues of users are marginal.

Web3 aims to change this by offering read, write, and own to users utilizing cryptography and decentralized networks. Starting with cryptocurrencies, web3 allowed users to own digital tokens usable within a network. Embedded into the internet, this creates a censorship resistant, independent digital payment medium, that once owned by a user cannot be taken away. Modern technologies like NFTs introduce tradable ownership of assets beyond simple currencies. Tokens, no matter if fungible or non-fungible give users digital property rights making web3 all about ‘owning’ on the internet. On the other hand, being programmable makes them more flexible and composable with other functionalities. Imagine NFTs that share a percentage of their traded value with the creators or pay tax at the time of trade transaction.

Like Web1, Web3 also depends on open-source protocols, but collectively owned through crypto economics. It is independent of traditional organizations, code executed as written. Web3 values open-source software, user ownership of data, permissionless access and creates a shared sense of identity and collaboration.

Ethereum may be one of the best examples where an open ecosystem allowing users to own pieces of the ecosystem has evolved into a 500-million-dollar market cap network with a huge community of developers, users, and a wide variety of applications. Developers join as they are incentivized to improve the ecosystem once they have ownership of the network. Users promote the network and educate others simply driven by the ownership they have in the network. Applications are created utilizing the infrastructure provided by Ethereum adding value with a multitude of use cases. From lending, borrowing to collecting carbon offsets to buying property or forming decentralized media organizations – users and developers join in on web3 because they can own a piece of what they are creating.

Characteristics of a decentralized web

Benefits of Web3

The networks will be more inclusive letting users or decentralized organizations (such as DAOs) to develop and operate in addition to businesses thereby setting the barrier low for users to have a stake in the game. Public data being open and distributed on these peer-to-peer networks creates transparency for auditing and accountability of transactions that happen on the network bypassing intermediaries. Decentralized networks can also neutralize the unilateral control exerted by centralized platforms and the content in Web3 is censorship resistant. Users will have more control over their digital identity and data.

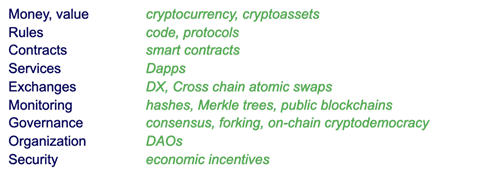

Decentralized applications will offer users new capabilities. Applications will self-organize and there will not be a single failure point. Money will become a native feature of the internet. Cryptocurrencies play a key role in the network. Governance of the network is done by the users and will be rewarded with incentives (tokens). The following is a list of comparative terms from today’s world and the equivalent or enablers in Web3:

Web 3.0 vs Web3

Web 3.0 was originally called the Semantic Web by World Wide Web inventor Tim Berners-Lee, and was aimed at the being a more autonomous, intelligent, and open internet. The Semantic Web is different from the Web3 - which focuses on decentralization.

Web3 use cases

Independent ownership of assets is a particularly important topic in areas where businesses do have little trust in each other. Supply chains, where different suppliers compete and do not want to trust competitors. Central, mutually trusted entities have so far helped mitigate this issue; however, a central entity is another instance of trust that is introduced into the equation. Competing suppliers will need to trust the central entity to not favor competition or abuse ownership of data. A decentralized network that allows entities to own their data and assets but still communicate peer to peer has immense potential. Usage of smart contracts for automatically executing a piece of code when a certain criterion is met or satisfied – smart contracts have potential to automate tasks and transactions in a variety of use cases.

Web3 and ownership of tokens bring many more use cases starting from simple peer to peer payments to embedding of tokens into businesses processes via micro transaction and all the way to remodeling of complete business models e.g., the provisioning of liquidity via tokens for invoice factoring.

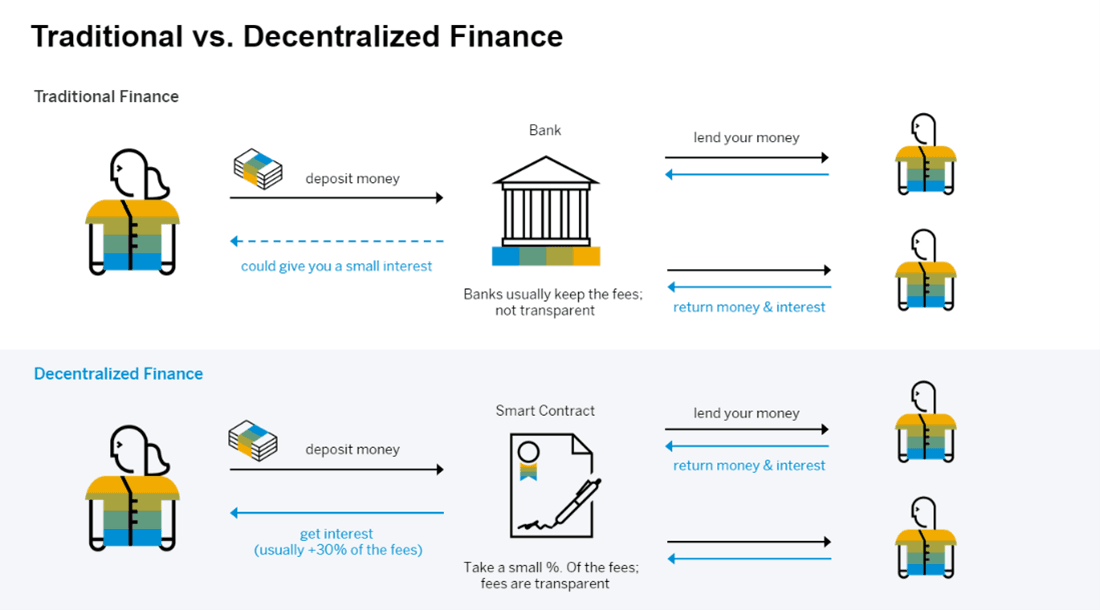

Cryptocurrency payments and Decentralized Finance (DeFi) applications are growing rapidly and are here to stay. Programmable money will blur the boundaries between business processes and financial services and can help provide superior value and user experience to customers.

Token-based incentives and the trust-less, decentralized nature of blockchain networks allow collaboration in competitive ecosystems. There is a push for decentralized ecosystems avoiding vendor lock-in and platform monopolies.

Incentive structures bring revenue streams for all participants via token ownership, staking and protocol fees. Blockchain as a technology choice without incentives rarely works.

Self-sovereign identity (SSI)

Non-Fungible Tokens (NFT)

Non-fungible Tokens (NFTs) have been among Web3's most active and visible components for the past two years. NFTs are blockchain based digital tokens that are designed to be unique and carry data and ownership tracked on an immutable ledger, in contrast to conventional cryptocurrencies, which have interchangeable units. A new "transaction" with the details of the new owner is recorded on the blockchain whenever an NFT token undergoes a change. Every transaction will leave a trail of information, and it is simple to determine the item's provenance and legitimacy by tracking ownership through the chain. NFTs fulfill their original purpose owing to three unique properties: Provenance, Indestructibility, and Indivisibility. NFTs are used in a variety of industries, including royalties tracking, sports, music, fashion & marketing, and online gaming. NFTs are anticipated to be used more in fields including supply chain management, identity verification, and in the metaverse as digital avatars.

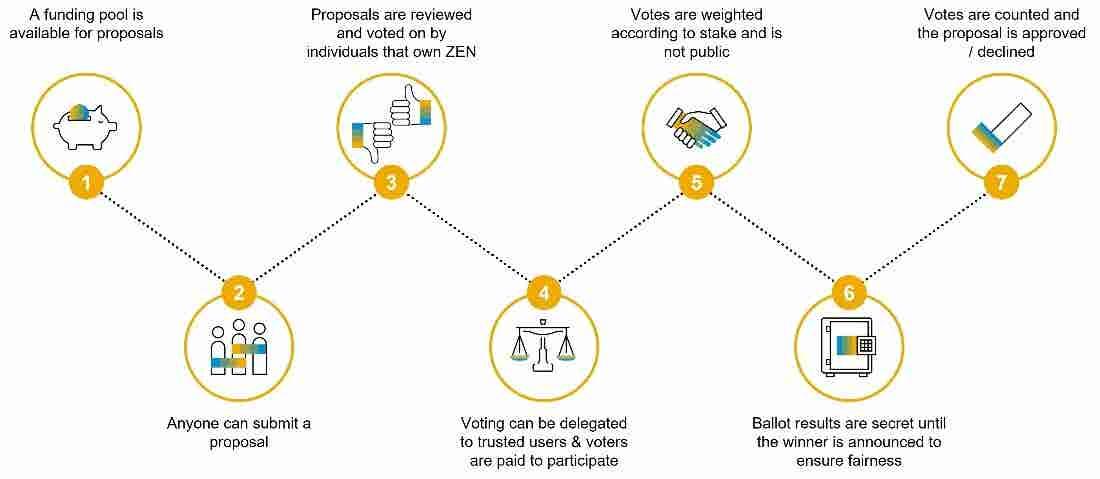

Decentralized Autonomous Organizations (DAO)

Decentralized Autonomous Organizations, also known as DAOs, are online member-owned communities that are led by their members' consensus rather than by centralized authority.

The following are the attributes of DAOs:

- Decentralized: No one person or centralized organization can alter the regulations.

- Votes are counted and decisions based on logic outlined in a smart contract are implemented autonomously, without the involvement of a human.

- Organizations are the entities responsible for coordinating activities among a dispersed group of stakeholders.

Traditional vs. Decentralized Finance (DeFi)

Metaverse & Web3

The terms ‘Metaverse’ and ‘Web3’ are being discussed together often in recent times. While both share a common vision of a better network / internet, they are fundamentally different. The misconception about these technologies must be addressed to work towards building the future internet.

Metaverse is "a mixed-reality space in which users can interact with a computer-generated environment and other users". Metaverse is more of a vision than reality. A vision where people have various views such as a 3D immersive world where every real-world object is present, a world where everything is synchronous, persistent, and limitless for the users. It is seen as a world where we would spend most of our time of a day in the future. It's an umbrella term for disparate ideas culminating together to form a global network of spatially organized, predominantly 3D content will be available to all without restriction. Metaverse is highly speculative as it hasn’t taken a form yet. It would be a combined effort and confluence of various technologies and innovations in hardware, human-computer interface, network infrastructure, creator tools and digital economies. Metaverse might not have one form.

Read more:

Web3 on the other hand is a paradigm of how the future network would function more decentralized whereas Metaverse is one of the many use cases of Web3 technologies. Other technologies such as NFTs (Non-Fungible Tokens), DAOs, Semantic web, 3D graphics and AI will play important roles in Metaverse. Web3 is a critical building block for metaverse but is just one component of a greater sum. The question of whether Web3will replace Web 2.0 is currently unanswered and considered mostly unlikely as the complexity involved in Web3 could hinder the adoption of all sorts of applications. Centralized systems are easier to build but are less transparent. Alternatively, both can co-existence, each having their own set of use cases and applications.

Relationship between Web3 and crypto

Cryptocurrencies and Decentralized Finance (DeFi) applications are growing rapidly and are likely here to stay – more than 23k businesses already accept crypto, $55bn Crypto purchases in 2021 with expected growth of 12.5% p.a. 85% of US merchants expect increasing digital currency adoption in the coming years. Crypto provides efficient access to bigger liquidity pools, move assets without brokers (prevent settlement risks & high costs) making it highly efficient compared to traditional finance. Programmable money could blur the boundaries between business processes and financial services and could help provide superior value and user experience to customers. Embedded Finance applications powered by DeFi could be a huge opportunity to unlock new value for enterprise customers. Crypto Analytics, Cross-border payments, Wallets, Invoice factoring, Salary payments etc., would potentially be impacted.

Factors influencing the success of Web3 & Crypto

The technology, distributed ledger, has been around for quite some time and has matured over the last few years. The challenge here is finding a balance between scalability, security, and decentralization of an ecosystem. The balance depends on the use case. Some applications require high scalability but can trade-off on decentralization instead.

The technology is ready to use, but on the human / social / business side it has the potential to disrupt many areas. A decentralized peer to peer network will give applications the potential to cut out intermediaries out of certain business processes. While there are still other issues to be solved, any type of marketplace or platform connecting two entities could face disruption. We can think of a taxi service. Current platforms connect drivers and people wanting to be driven. This quite simple set of software could be built within a decentralized network and thus has the potential to disrupt the service business cutting out middlemen. Many other such platforms, of course, offer far more sophisticated services than described here, but there is a risk and a requirement for businesses to assess whether this risk is a threat to their own operations or an opportunity for a new business model.

From a regulatory perspective, crypto is legal in most countries, and companies can transact and hold it on their balance sheets. The European Commission is working on risk-based regulations to ensure innovation will not be slowed down, instead giving clarity to corporations in handling crypto.

In some countries, cryptocurrencies are accounted as intangibles and the implications of this on holding and accounting need to be investigated further. Furthermore, embedding functionality into processes could be seen as trading and depends on whether tokens are securities or utility tokens. Applications use utility tokens which are seen as access rights to an application and thus not regulated as financial assets like security tokens are.

EY (Ernst & Young) expects regulators to take a risk-based approach to allow for innovation and the European Commission confirms this strategy.

SAP & Web3

SAP has always been at the forefront of technological advancements and has embraced relevant technologies which fulfil customers’ emerging requirements. Web3 opens opportunities for new network-based innovation for businesses by means of a large, trusted ecosystem. SAP’s enthusiastic innovators are evaluating and exploring the multifarious potential of Web3 and its use cases in the enterprise context. And derives new requirements to further enhance the capabilities of SAP's Business Technology Platform.

Meet the experts - Contact

If you want to learn more about how Web3 can be used in business, feel free to reach out to us via: innovation.rocks.mee@sap.com

Thanks to Madhubala Ganesan for sharing your expertise!

Read more:

- How the role of an innovation manager can help you to accelerate your digital transformation

- What you can do with NFTs in a business environment

- How the Metaverse might impact the way businesses work in the future

- Virtual Reality business applications

Stay tuned and learn more: digital innovation and technologies